.avif)

PORT-OF-SPAIN, July 12, 2022 — Massy Finance today announced it had partnered with Carilend, a leading financial-technology firm out of Barbados, to offer 100% web-based personal loans up to $50,000 on the local market, its first foray into the fintech space and a clear expansion of the bank’s horizons under new Managing Director Duane Hinkson.

The new online loan, known as InstaLoan, is an unsecured personal loan that promises a one-day turnaround on approvals, and doesn’t require borrowers to provide collateral. Not only that, as part of the loan terms, customers can qualify for loans between $5,000 and $50,000 with repayment terms from one to five years.

According to Hinkson, InstaLoan is an ideal option for borrowers looking for a fast, easy, and secure way to apply for credit to meet expenses like credit card debt, home improvement, car repairs, and unplanned emergencies — without the back-and-forth associated with traditional brick-and-mortar lending.

Yet, before InstaLoan, Massy Finance might easily have fit that description itself, with much of its other lending business built around the same paper-based loan origination practices you would find at other banks.

Now, the business model is evolving. By leveraging Carilend’s proprietary technology, the company is staking its future on becoming a digital-first bank. For Hinkson, who took the helm in August 2021, it’s all part of a broader strategy to improve the customer experience and win market share from larger incumbents.

“We see this partnership as an opportunity to provide financing to more people while moving the bank toward digital maturity, so we’re especially interested in those customers who rely on their phones to do everything,” said Hinkson. “InstaLoan would be an excellent option for this group.”

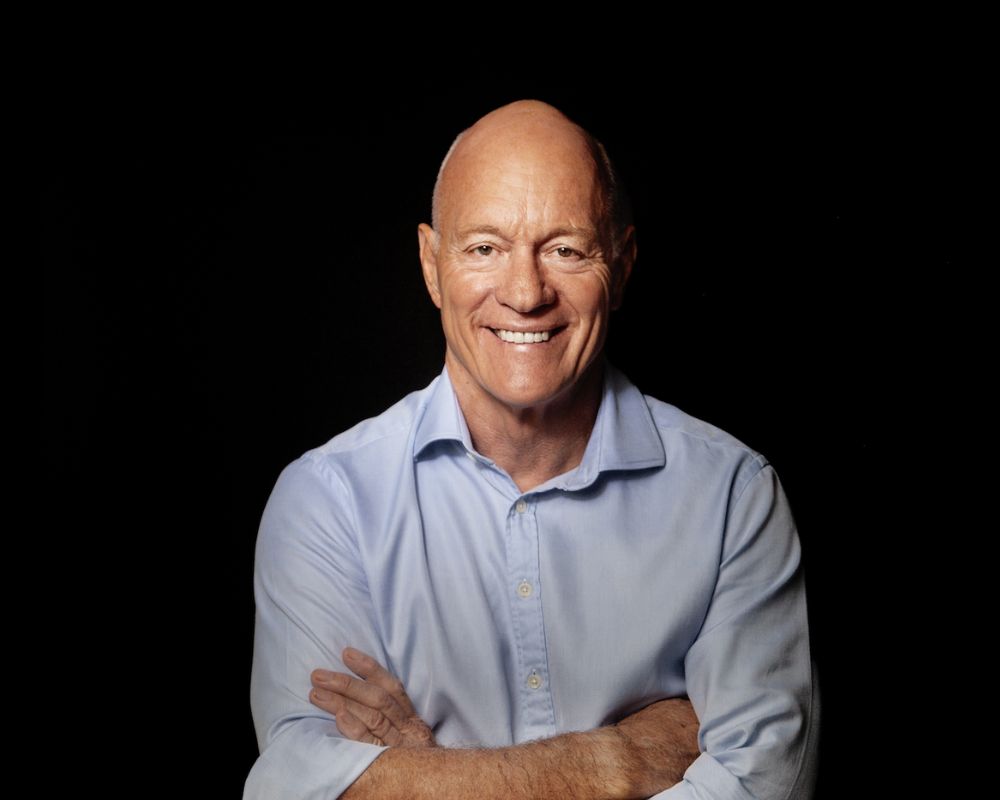

Mark Young, Carilend’s chief executive, believes the timing may be right for the move toward online lending, not least because of the covid19 pandemic.

“After covid, the emerging picture is clearly one where people want to do everything online. Borrowing is no exception, so the industry as a whole has to respond, and that’s what Carilend and Massy Finance are doing. Quick, easy, and convenient is our business model,” said Young.

He has at least one other reason to be optimistic: It’s not Carilend’s first rodeo.

In 2017, the fintech startup launched the first peer-to-peer lending service in Barbados. Three years later, they partnered with the VM Group in Jamaica to provide quick and easy online loans to Jamaicans. Taking a measure of Carilend’s potential, the VM Group took a 30 percent stake in the company in 2019 through its publicly-listed investment banking subsidiary VM Investments. The deal also made Carilend an associate company of the VM Group.

Taken together, the Carilend platform facilitated about US$50 million in loans over the period. Now they are bringing the technology to Trinidad and Tobago consumers with the powerful backing of Massy Finance.

Under the deal, which was finalised in May, Massy Finance and Carilend will tap a mix of technology and data inputs to reach more borrowers online. Young said Carilend had already opened a local office in anticipation of increased demand for InstaLoan, which borrowers can apply for at instaloan.massyfinance.com.

The official launch is scheduled for July 14 at the BRIX hotel Port-of -Spain, Trinidad. The media is invited to cover the event.

For any queries contact Mark Young, CEO Carilend, mark.young@carilend.com

Ph: +1(246) 231 7553

-6.avif)

-61.avif)

-48.avif)

-11.avif)

.avif)

-62.avif)

-54.avif)

-10.avif)

.jpeg)